As the federal tax deadline approaches, there’s still time to claim your pandemic-era IRS stimulus check. With the deadline for filing taxes on April 15, 2024, this is your final chance to collect any outstanding stimulus payments, including the $1,400 for individuals, $2,800 for married couples, or up to $5,600 for families with two eligible dependents. If you haven’t received the funds, you may still be able to claim the recovery rebate credit for the 2021 tax year, but you must act before the April 15 deadline.

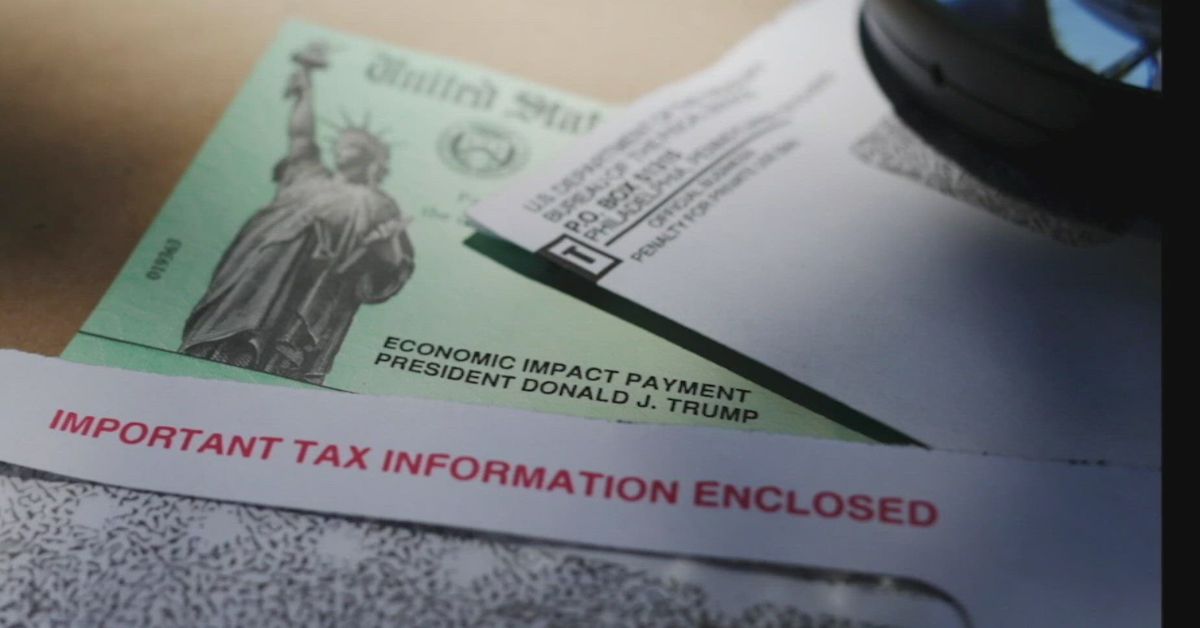

The pandemic stimulus checks were part of the government’s relief efforts to help individuals and families manage the financial hardships caused by COVID-19. However, some taxpayers may not have received their full stimulus payments or may not have received them at all. If you are one of those people, the good news is that you have a chance to claim the missing funds by filing your 2021 tax return before the deadline.

To determine if you are eligible for the recovery rebate credit and your stimulus payment, it’s important to check your IRS online account. The IRS provides an easy-to-use portal where taxpayers can access their tax records, including details on any stimulus payments that were issued. If you didn’t receive the full amount you were eligible for, the IRS allows you to claim the difference on your 2021 return. This is important because if you miss the deadline to claim your stimulus payment, you could lose your chance to receive that money.

For many, it’s easy to forget whether or not they received their full stimulus check. If you’re unsure, logging into your IRS online account can provide clarity. After creating an account, you’ll be able to view your tax records, including your stimulus check details.

According to Tommy Lucas, a certified financial planner and enrolled agent based in Orlando, Florida, your online IRS account is the best place to confirm your stimulus payment status. Once logged in, you can navigate to the “tax records” section and find your payment information under the “records and status” tab.

Many taxpayers may wonder if they are still eligible to claim the recovery rebate credit. The good news is that you may be eligible if your adjusted gross income (AGI) for 2021 was within the income limits set by the IRS. To claim the full $1,400 stimulus check as a single filer, your AGI must be $75,000 or less. For married couples filing jointly, the income limit is $150,000. Families with children may be eligible for even larger payments, depending on the number of eligible dependents.

However, stimulus payment eligibility has begun to be phased out for higher-income earners. If your AGI exceeds $75,000 as a single filer or $150,000 as a married couple filing jointly, you may still be eligible for a partial payment. Once your AGI reaches $80,000 for single filers or $160,000 for married couples filing jointly, you will no longer qualify for the recovery rebate credit.

If you haven’t filed your 2021 tax return yet, you must do so before the April 15 deadline to claim the recovery rebate credit. Even if you don’t usually file a tax return, you need to submit one to claim the stimulus payment. Some people may not have earned enough income to be required to file taxes, but the IRS still requires a tax return to claim the credit. It’s essential to file your return before the deadline to ensure that you don’t miss out on any funds you may be entitled to.

According to Syracuse University law professor Robert Nassau, who directs the school’s low-income tax clinic, it’s crucial to file your 2021 tax return even if you have any doubts about whether you received your full stimulus check. “If there’s any doubt about whether you received your full stimulus payment, it’s best to file your return and claim the recovery rebate credit,” said Nassau. “Otherwise, you could miss the deadline and lose your chance to collect the money.”

In December 2024, the IRS announced plans to send “special payments” to approximately 1 million taxpayers who had not claimed the 2021 recovery rebate credit. These payments were scheduled to be issued by direct deposit or mailed check by the end of January 2025. If you are one of those taxpayers, you may still be able to receive the funds, but you must ensure that your 2021 tax return is filed by the deadline.

Filing your tax return before the April 15 deadline ensures that you will not miss out on any funds that could help you during this financial year. Once you file your return and claim the recovery rebate credit, you may be eligible for a refund that could arrive in the form of a direct deposit or a mailed check. If you are expecting a direct deposit, it may take several weeks for the IRS to process your payment.

One of the easiest ways to stay on top of your IRS payments is to check your online account regularly. The IRS offers a straightforward portal that allows you to view your tax records and track the status of your economic impact payments. If you haven’t done so already, creating an IRS account will help you stay informed about any stimulus payments or tax refunds that you may be eligible for.

As the deadline approaches, it’s important to act quickly if you want to claim your pandemic-era stimulus payment. If you don’t file your 2021 return by April 15, you could lose your chance to collect the $1,400 stimulus payment or any other funds you may be entitled to. This is your final opportunity to receive the funds you may have missed earlier.

So, if you haven’t already, take a moment to check your IRS online account and make sure you’re filing your 2021 tax return before the deadline. It’s a simple and important step to ensure you don’t miss out on your stimulus payment. Time is running out, and the April 15 deadline is fast approaching.

Disclaimer: This article has been meticulously fact-checked by our team to ensure accuracy and uphold transparency. We strive to deliver trustworthy and dependable content to our readers.