By the Associated Press’s Melissa Goldin

Don’t go over budget just yet.

Online rumors circulated on Friday that taxpayers in specific income levels would soon get stimulus payments from the US government.

However, the IRS reports that no new stimulus cheques would be issued in the upcoming weeks, and Congress has not passed legislation authorizing such payments.

Let’s examine the facts in more detail.

CLAIM: By the end of the summer, low- and middle-income taxpayers will get $1,390 stimulus cheques that were approved by the Treasury Department and the Internal Revenue Service.

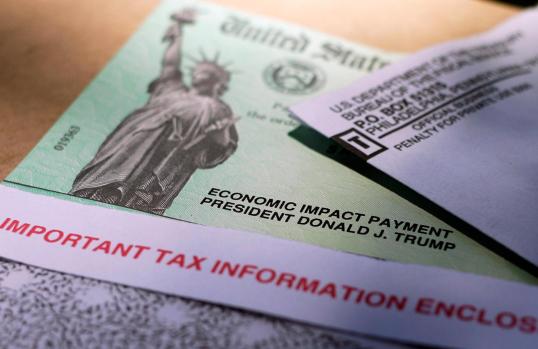

THE FACTS: It is not true. According to an IRS official, taxpayers will not receive any additional stimulus payouts this summer. The Treasury Department distributes stimulus checks, sometimes referred to as economic impact payments, which are approved by Congress through law. Last month, Missouri Senator Josh Hawley, a Republican, submitted a plan that would use the money from tariffs imposed by President Donald Trump to provide tax refunds to eligible taxpayers. Neither the House nor the Senate have approved Hawley’s bill.

Early this year, the IRS declared that it will pay out roughly $2.4 billion to taxpayers who neglected to include a Recovery Rebate Credit—a refundable credit for those who did not get one or more COVID-19 stimulus checks—on their 2021 tax returns. The upper limit was $1,400 per person.

To be eligible for the benefit, those who hadn’t already filed their 2021 tax return had to do so by April 15. According to the IRS official, taxpayers are not eligible for any new credits.

In the past, Congress has authorized stimulus cheques through legislation. For instance, three bills—the American Rescue Plan Act, the COVID-related Tax Relief Act, and the Coronavirus Aid, Relief and Economic Security Act—made it possible to make payments during the coronavirus pandemic.

The Economic Stimulus Act of 2008 authorized stimulus cheques in response to the Great Recession.

Related Articles

-

NH man pleads guilty to killing sister-in-law, 2 nephews

-

Hurricane Erin expected to soak Virgin Islands, Puerto Rico before heading north

-

Middletown man lured Grindr date from LI, stabbed him in eye, neck and torso: DA

-

Today in History: August 15, power restored after largest blackout in U.S. history

-

Alex Jones Infowars assets to go on sale again to pay Sandy Hook families

During the Great Recession and the COVID-19 pandemic, stimulus monies were disbursed by the Treasury Department, which includes the Internal Revenue Service. During the previous crises, the Treasury’s Bureau of the Fiscal Service, which was established in 2012, also contributed.

The American Worker Rebate Act, which Hawley filed in July, would provide tariff income to eligible Americans in the form of tax refunds. The suggested refunds would total at least $600 for each person, plus more for kids who qualify. If tariff income is larger than anticipated, rebates may rise. A smaller refund would be given to taxpayers whose adjusted yearly gross income was beyond a specific threshold, which is $75,000 for individuals filing on their own.

Americans should receive a tax refund, according to Hawley.

“My legislation would enable hard-working Americans to reap the benefits of the wealth that Trump’s tariffs are bringing back to this nation, just as President Trump suggested,” Hawley stated in a press release.

As of Friday, neither the House nor the Senate has approved the American Worker Rebate Act. On July 28, the day it was introduced, the Senate read it twice and submitted it to the Committee on Finance.

Visit https://apnews.com/APFactCheck to find AP Fact Checks.